Equity Investment Process

Our portfolio managers utilize independent securities analysis and proprietary screening of various databases as well as research from Wall Street and regional firms to select stocks. The portfolio managers are not constrained by market caps and can buy across all capitalizations if price represents a significant discount to our estimate of intrinsic value.

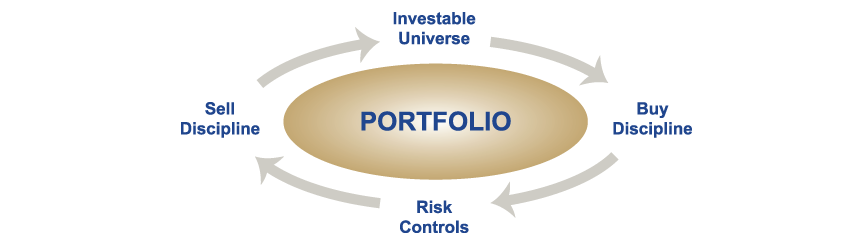

| Investable Universe | Buy Discipline | Risk Controls | Sell Discipline |

|---|---|---|---|

| Primary benchmark is selected | Purchase shares of companies that we believe are financially sound when they are out of favor and attractively priced Stocks are evaluated by placing an emphasis on companies with what we consider to be superior business characteristics, including high return on equity, high profit margins, above-average revenue growth prospects, low debt and are attractively priced | Diversify across industries Generally limit position sizes from 1-3% at time of purchase Top-down/Macro adjustments | Stock price exceeds our estimate of intrinsic value Company fails to achieve expected financial results Economic factors or competitive developments adversely impair the company's value |